Abstract :

Gamma is a change in the price of a derivative with a change in underlying at a changing rate (2nd degree). In the electricity markets the phenomenon is seen that when electricity prices deviate from the expected price, the load to serve also deviates. This correlation creates a compounding effect on losses. Historically, in vertically-integrated regulated markets, the utility owns all the peaker plants necessary to cover these events. In de-regulated markets, these functions are broken up, but connected through options gamma hedging. A novel alternative I propose is to use energy storage to cover these events. This is a novel use for energy storage distinct from arbitrage, solar combination, or back-up applications. This paper compares the costs of hedging against gamma events using energy storage vs. financial options.

Introduction

Gamma is the second degree price change of a derivative with the price change of an underlying (The Greeks). This creates exponential moves in the derivative as compared to the underlying. In the electric industry, this is seen in the set-up of a retailer having to buy electricity from the wholesale market and sell to consumers at a fixed rate. The retailer is able to hedge their predicted load with a future to match the fixed rate and predicted load. This is a fairly straight forward delta hedge which ensures a fixed profit as prices (and only prices) deviate. The problem is that this doesn’t take into account a deviation of volume of load from what was predicted. The econo-physical fact is that there is a correlation between volume and prices. When load is higher than expected, prices react by rising, and when load is lower than expected, prices drop. This is supply and demand economics. I refer to times when both price and load highly deviate from expected as “gamma events”.

The profitability is governed by the product of the volume of electricity and the difference in retail and wholesale rates. The volume (V) and wholesale price (p) can deviate from expected which creates financial risk (Equation 1- Profitability).

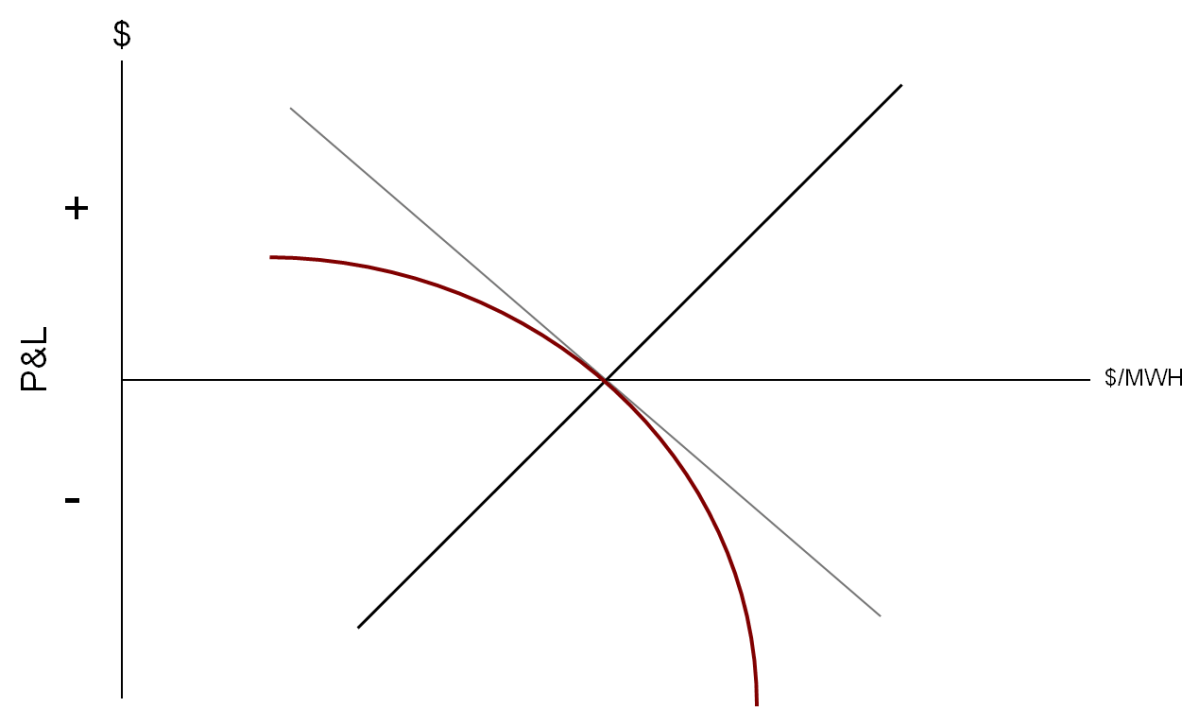

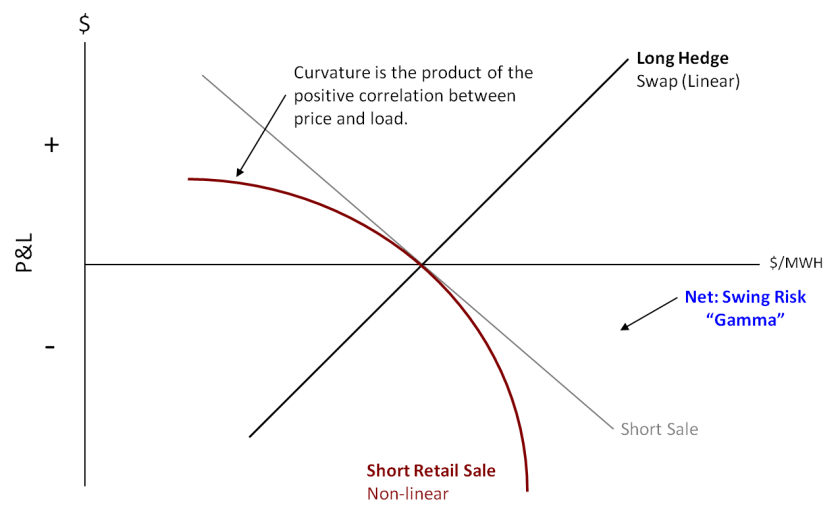

We can see the effects of this risk in Figure 1- Gamma Risk which shows the company’s obligatory load to serve short position, the future hedge long position, and the deviation from the $0 P&L gamma position. The problem is that the retailer feels the negative effects on profit/loss in both directions. When prices drop, they are forced to sell back excessive electricity at depressed prices. They’re protected against price drops, but not for the decreased volume. On the price up side, they are forced to buy additional electricity at higher prices. Once again, they are hedged against price increases, but no longer at the proper volume. When both are combined in the profit equation, this creates a downward droop in their P&L.

In trying to compensate for this gamma risk, various solutions have been proposed. In vertically-integrated energy markets, the utilities own the peaker power plants necessary for these events. The principal alternative is to cover distinct deviations from expected by building an options portfolio at strike prices form at the money. This is best described by Oum, Oren, and Deng (Oum, Oren, & Deng, 2010). Other alternatives include using weather options, or volumetric option as proposed by Lloyd Spencer (Spencer, 2001).

One novel solution that has not been examined is to use energy storage for gamma events. I have not been able to find any instances of energy storage being used exclusively for lower probability events of high price & load or low price & load. This would be distinct from more common storages uses of price arbitrage, solar panel combination, or black-out back-up (RMI). The question is whether energy storage is a cost-effective alternative to options gamma hedging.

Scenario/Assumptions

I analyze the two alternatives from the viewpoint of a retail electricity provider. It must provide electricity to customers at a fixed rate and buy it on the wholesale market. It owns no generation sources itself.

Data comes from PJM-West wholesale market. Data for these wholesale prices can be found at PJM’s website (Wholesale Prices). Load to serve comes from PJM’s estimated load (Estimated Load). These are hourly data points for the whole year of 2016. Predicted load and price were created by taking random normal deviations at a 15% scale. The correlation between load and price is .5 for both predicted and actual. This is a bit low of a correlation for gamma risk to take place, but will suffice for this analysis.

The cost of gamma risk comes from a volume which deviates from expected. Price deviations at load volumes consistent with what was predicted are already covered in the theta (futures) hedge that was put on. This means that the gamma hedge to be concerned with is the price deviations multiplied by load deviations, Equation 2 – Gamma P&L.

In an effort to keep things consistent, I only consider deviations that create 95th percentile profit losses. These are when the load and price deviation have the same sign to create a loss. I measure deviations in terms of dollar moves (strikes) of actual prices from predicted prices (at-the-money). The energy deviations are then calculated at each strike point.

Financial Options Hedging

The cost of the financial options hedge can be constructed by finding the cost of calls and puts as strike deviations from the at-the-money strike. The at-the-money strike can be considered to be the price of the future since the option delivers into the future contract. The future contract can be considered to be expected or predicted price. A generalized schedule of this options cost can be prepared based on a day for options two months out. I use options on PJM Western Hub Real-Time Peak Fixed Price Future prices on March 23, 2017 for May 2017 contracts (ICE Options Report) – Figure 2 – Options Prices.

The difference between expected and actual price is the same as an options strike deviation from the at-the-money price telling us historically which options strikes would have been needed. Finally, the load deviation tells us how many contracts would have been needed. As we pay for these whether they are used or not, this is the total cost of hedging 95th percentile gamma moves or greater with financial options.

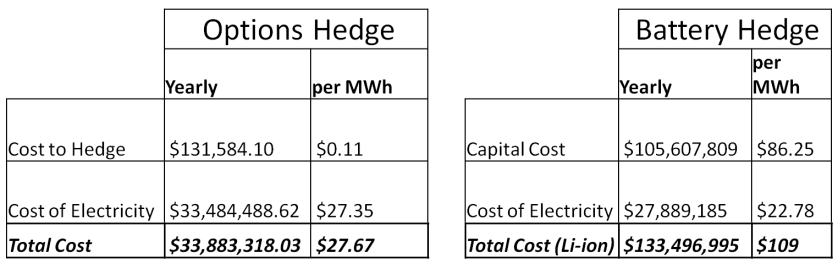

Excluding 95% of the hours ensures we are not wasting our time on small profitability losses, and it ensures we are not studying a battery for a cyclical time-of-use arbitrage scenario. Everything can then be re-categorized by summation into the strike distance from at-the-money. The costs incurred are then split between the cost of the option itself and the cost of the underlying electricity at the price that the option affords us the right to buy it. This is taken as the predicted price for each strike multiplied by the summed absolute value of load deviations.It can be seen in that the cost of the option itself is minimal in comparison to the cost of electricity.

Energy Storage Hedging

It is proposed that energy storage can help serve unplanned, un-hedged load and lower the down-side risk. By charging at lower cost times in preparation to serve unplanned load, battery storage can mitigate having to buy extra electricity at high wholesale prices. This scenario would entail operating a battery with a different algorithm than typical time-of-use, back-up, or ancillary support models.

The cost of using a battery is comprised of two costs, the cost to charge the battery and capital costs. I calculate the cost to charge the battery as the 20th percentile price of all energy. This is combined with the energy across the whole year of 1,224,474 MWh. An estimated efficiency loss of 15% gives a yearly cost of electricity at $20,149,936.

The O&M cost includes the cost of the battery itself and maintenance costs. The longest 95th percentile gamma event only lasts 3 hours with 2,843 MWh needed across these 3 hours. This largest demand is the size of the battery needed. This power and energy scale would only be achievable with a distributed storage network. The capital cost of a flow battery is $372-$1,115 ($743 avg) per kWh (Lazard). Adding in a battery lifespan of 20 years, the Capital cost is calculated to be $105,607,809.41. For purposes of simplicity, this doesn’t included maintenance cost or inflation. The combined cost of the battery is $133,496,994 or $109 per MWh.

Conclusion

Comparing the costs of covering 95th percentile gamma events using financial options vs. batteries entails calculating the cost of electricity and options price or capital costs for each. The significant drivers are that the battery is able to use a much lower cost of electricity because it can charge when prices are lower compared to the options price of electricity being based on predictions. However, the capital costs for batteries are significantly higher than the options price cost. This makes energy storage the higher cost option. Even with cheaper hydro-electric capital costs of $300 per kWh, the total energy storage cost per MWh of $57 is higher than options.

Future Work

There have been quite a few factors that have been left out or oversimplified including costs of batteries, cost of electricity for the battery, and options prices. Another consideration is that a 2,843 MWh battery deserves a qualification. This would have to be distributed storage. It would also be more likely that anything past 99th percentile losses wouldn’t be planned for. A more detailed economic analysis taking into account the time value of money, maintenance costs, and tax considerations that use better qualified inputs would also be valuable.

Future work includes doing a back-test that would better model the actual cash flows in each hour. In practice, this situation could also be done by owning the batteries and selling options. You could gain money by collecting on the price of options, and then when a gamma event happens, you could pay the option with the income generated from selling the battery reserves onto the market. This would be a similar analysis from a different agent’s perspective.

Works Cited

Estimated Load. (n.d.). Retrieved from PJM: http://www.pjm.com/markets-and-operations/energy/real-time/loadhryr.aspx

ICE Options Report. (n.d.). Retrieved from ICE: https://www.theice.com/marketdata/reports/143

Lazard. (n.d.). Lazard’s Levelized Cost of Storage Analysis. Lazard. Retrieved from https://www.lazard.com/media/2391/lazards-levelized-cost-of-storage-analysis-10.pdf

Meerdink, E. (n.d.). Hedging Retail Electricity. Hess Corporation. Retrieved from https://www.slideshare.net/EricMeerdink/euci-sep2011-ericmeerdink

Oum, Y., Oren, S., & Deng, S. (2010). Volumetric Hedging in Electricity Procurement. Retrieved from http://www.ieor.berkeley.edu/~oren/pubs/Volumetric2005.pdf

RMI. (n.d.). The Economics of Battery Storage. Retrieved from http://www.rmi.org/Content/Files/RMI-TheEconomicsOfBatteryEnergyStorage-FullReport-FINAL.pdf

Spencer, L. (2001, Oct 1). The Risk That Wasn’t Hedged: So What’s you Gamma Position? Fortnightly Magazine. Retrieved from https://www.fortnightly.com/fortnightly/2001/10/risk-wasnt-hedged-so-whats-your-gamma-position?page=0%2C0

The Greeks. (n.d.). Retrieved from thismatter.com: http://thismatter.com/money/options/greeks.htm

Wholesale Prices. (n.d.). Retrieved from PJM: http://www.pjm.com/markets-and-operations/energy/real-time/loadhryr.aspx